Top Misunderstandings and Inaccuracies About the Offshore Trust

Top Misunderstandings and Inaccuracies About the Offshore Trust

Blog Article

Learn How an Offshore Trust Can Boost Your Estate Planning Method

If you're looking to reinforce your estate planning technique, an offshore Trust might be the service you require. Let's discover what an offshore Trust can do for you.

Recognizing Offshore Depends On: What They Are and How They Work

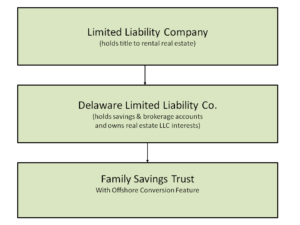

Offshore counts on are powerful financial devices that can aid you manage your properties while supplying benefits like privacy and tax advantages. Generally, an overseas Trust is a lawful plan where you transfer your assets to a trust developed in a foreign territory. This setup permits you to separate possession from control, meaning you don't straight own the possessions anymore; the Trust does.

You'll assign a trustee to take care of the Trust, ensuring your assets are handled according to your dreams. By understanding just how offshore trusts work, you can make enlightened decisions that line up with your economic objectives and offer tranquility of mind for your family members's future.

Key Benefits of Offshore Trust Funds for Asset Security

While you might not constantly have the ability to predict monetary difficulties, developing an overseas Trust can be a positive action towards shielding your assets. One essential benefit is the included layer of protection it provides against lenders and legal judgments. By putting your properties in an overseas Trust, you develop a barrier that makes it harder for potential claimants to reach your wealth.

Furthermore, offshore depends on can assist you secure your properties from financial or political instability in your house nation. This geographical splitting up assurances that your riches continues to be safe, also if your domestic circumstance modifications suddenly.

One more advantage is the potential for anonymity. Several overseas territories enable for higher privacy, making it challenging for others to discover your financial holdings. This confidentiality can hinder unimportant legal actions and undesirable interest. In general, an offshore Trust can be an effective tool in your asset protection approach, providing you peace of mind.

Tax Benefits of Establishing an Offshore Trust

When you establish an offshore Trust, you not just boost your asset defense yet likewise expose important tax obligation deferral opportunities. This can significantly lower your taxed earnings and assist your wealth expand over time. Recognizing these benefits can be a game-changer in your estate preparation approach.

Asset Defense Benefits

Establishing an overseas Trust can greatly enhance your property security strategy, especially if you're aiming to shield your wealth from creditors and legal judgments. By putting your assets in a depend on, you efficiently separate them from your personal estate, making it harder for creditors to access them. This included layer of protection can discourage suits and give satisfaction.

Additionally, several offshore jurisdictions have durable privacy laws, ensuring your financial events continue to be confidential. In case of legal disagreements, having possessions held in an offshore Trust can complicate efforts to take those possessions, as it's more difficult for financial institutions to browse foreign laws. Inevitably, an offshore Trust is a powerful device in guarding your riches for future generations.

Tax Deferment Opportunities

Offshore trust funds not only provide robust asset protection yet additionally existing considerable tax obligation deferral possibilities. By positioning your assets in an offshore Trust, you can potentially defer taxes on earnings and funding gains until you withdraw those funds. This technique enables your financial investments to expand without instant tax obligation liabilities, optimizing your riches with time.

In addition, depending on the territory, you could take advantage of lower tax prices or also no tax obligations on particular sorts of revenue. This can offer you with an extra favorable setting for your financial investments. Using an overseas Trust can boost your general estate planning technique, enabling you to control your tax direct exposure while protecting your assets for future generations.

Enhancing Personal Privacy and Discretion With Offshore Trusts

While many individuals seek methods to safeguard their assets, using offshore trusts can greatly boost your personal privacy and privacy. By placing your possessions in an offshore Trust, you create a layer of defense against prospective creditors, legal actions, and public scrutiny. This framework usually guarantees that your personal details remains exclusive, as offshore territories often use strict privacy regulations.

Furthermore, the properties kept in the Trust look at this website are not openly divulged, allowing you to manage your wide range discreetly. You can likewise manage just how and when beneficiaries access their inheritances, additionally securing your intentions from prying eyes.

In addition, the intricate legal frameworks of overseas trust funds can deter those attempting to challenge or access your properties (offshore trust). Ultimately, choosing an offshore Trust encourages you to maintain your financial privacy, offering satisfaction as you browse your estate intending journey

Planning for Future Generations: Wealth Transfer Methods

As you take into consideration the personal privacy advantages of offshore trusts, it's equally crucial to consider just how to properly hand down your wealth to future generations. Offshore trusts can serve as powerful tools for wide range transfer, allowing you to dictate exactly how and when your possessions are distributed. By establishing an offshore Trust, you can set specific terms to guarantee that your heirs receive their inheritance under conditions that line up with your values.

Additionally, overseas depends on typically provide tax obligation advantages, which can aid maintain your wealth for future generations. You can structure the Trust to safeguard your properties from lenders or legal cases, guaranteeing that your enjoyed ones benefit from your tough work.

Usual False Impressions Concerning Offshore Counts On

What do you actually recognize concerning offshore trusts? In reality, offshore trusts can be legitimate tools for estate planning and asset defense for a wider target market. By recognizing these false impressions, you can make enlightened choices concerning whether an overseas Trust fits your estate planning strategy.

Actions to Developing an Offshore Trust as Part of Your Estate Plan

Selecting a Territory

Choosing the ideal territory for your offshore Trust is necessary, as it can my sources significantly affect the performance of your estate plan. Beginning by investigating nations with desirable Trust regulations, tax obligation advantages, and strong property security. In addition, think about the expenses connected with establishing up and maintaining the Trust in that jurisdiction, as fees can vary significantly.

Picking a Trustee

Just how do you guarantee your offshore Trust operates smoothly and efficiently? The crucial depend on picking the appropriate trustee. You'll desire a person trustworthy, experienced, and educated about the laws governing your chosen jurisdiction. Consider professionals like attorneys or financial advisors that concentrate on overseas trust funds. They recognize the subtleties of taking care of properties throughout borders and can navigate potential legal intricacies (offshore trust).

You need to likewise examine their communication style-- guarantee they're receptive and transparent. Examine their fees upfront to avoid shocks later. It's sensible to evaluate their track record with various other clients. A strong online reputation can offer you confidence that your Trust will be managed successfully, aligning with your estate planning goals. Choose intelligently, and your offshore Trust can prosper.

Funding the Trust

Once you've selected the ideal trustee for your offshore Trust, the following step is moneying it effectively. You'll intend to transfer possessions right into the depend ensure it achieves your estate preparing objectives. Begin by recognizing which assets to consist of-- this could be money, financial investments, realty, or organization interests. Seek advice from with your trustee and legal consultant to establish the best technique for moving these assets.

Bear in mind the tax obligation effects and the regulations of the offshore jurisdiction. Make sure to record each transfer properly to maintain transparency and adhere to legal demands. When moneyed, your overseas Trust can give the advantages you seek, such as possession security and tax effectiveness, improving your general estate planning method.

Often Asked Concerns

What Is the Distinction In Between an Offshore Trust and a Domestic Trust?

An offshore Trust's assets are held outside your home country, offering personal privacy and potential tax obligation advantages. In comparison, a residential Trust runs within your country's legislations, commonly doing not have the exact same level of asset protection and confidentiality.

Can I Handle My Offshore Trust Possessions Directly?

You can't handle your overseas Trust assets directly as a result of lawful limitations. Instead, a trustee supervises those assets, ensuring conformity with laws and securing your rate of interests while you benefit from the Trust's benefits.

Are Offshore Trusts Legal in My Nation?

Yes, overseas counts on are legal in many nations, yet guidelines vary. You'll require to research your country's laws or get in touch with a lawful professional to guarantee conformity and comprehend any tax obligation ramifications involved.

Just how much Does It Price to Establish an Offshore Trust?

Establishing up an overseas Trust typically sets you back in between $5,000 and $20,000, depending on the intricacy and territory. You'll intend to talk to a legal expert to obtain a precise estimate for your details requirements.

What Happens to My Offshore Trust if I Move Nations?

If you relocate countries, your overseas Trust's tax ramifications and legal standing might transform. You'll need to seek advice from experts in both territories to ensure conformity and make required adjustments to maintain its advantages and protections.

Verdict

Incorporating an overseas Trust right into your estate preparation can be a game-changer. Don't allow false impressions hold you back; with the right support, you can develop an overseas Trust that truly safeguards your heritage.

Primarily, an offshore Trust is a legal plan where you transfer your possessions to a trust fund developed in an international territory. In the occasion of lawful disputes, having assets held in an offshore Trust can complicate attempts to seize those assets, as it's their website more challenging for lenders to navigate foreign laws. Utilizing an offshore Trust can enhance your total estate preparation approach, permitting you to control your tax direct exposure while protecting your possessions for future generations.

When funded, your offshore Trust can provide the advantages you look for, such as property security and tax performance, boosting your general estate planning technique.

What Is the Difference In Between an Offshore Trust and a Domestic Trust?

Report this page